Atal Pension Yojana Chart 2023: AAY, originally Swavalamban Yojana (SAI), is a government-backed pension program in India that focuses mostly on the unorganized sector. The program was initially suggested by Arun Jaitley, who was the finance minister at the time, in his 2015 budget speech. On May 9, 2015, Prime Minister Narendra Modi unveiled the program in Kolkata.

All individuals who were covered by the National Pension Scheme (NPS) and the Pension Fund Regulatory and Development Authority (PAFFARD) Act 2013 were eligible for the government-sponsored Swavalamban Yojana pension program. Each NPS account formed between 2010–11 and 2013–14 received a contribution from the Government of India under the system of $1,000 (or $13) annually, with a maximum payment of $12,000 (or $150) annually. The Government of India provided a grant to fund the program.

Table of Contents

Atal Pension Yojana Chart 2023

The Atal Pension Yojana has taken the role of the Swavalamban Yojana, which currently offers all subscriber employees under the age of 40 a pension of up to 5,000 (or $63) a month upon reaching the age of 60. Atal Bihari Vajpayee, a former Indian prime minister, is the program’s name.

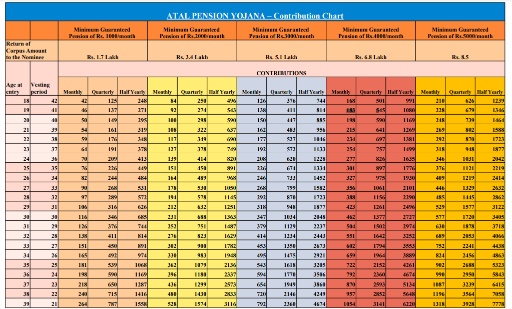

Atal Pension Yojana Chart PDF

Every APY holder wants to view Atal Pension Yojana Chart, here we share this chart via image and pdf link on this post. Atal Pension Yojana Age is 18 to 40 years old for all people. Every scheme holder can pay for this pension Monthly, Quarterly, and Half Yearly based.

Atal Pension Yojana Chart 2023 PDF View Link: Atal Pension Yojana Chart PDF

About Atal Pension Yojana

| Name | Atal Pension Yojana/ Atal Pension Yojana Chart |

| Date of Launching | Mr. Narendra Modi |

| Launched By | Department of Financial Services, Government of India |

| Regulatory Body | Pension Fund Regulatory And Development Authority |

| Department | Department of Financial Services, Government of India |

| Ministry | Ministry of Finance |

Features of Atal Pension Yojana 2023

- Anyone who is an Indian citizen and is between the ages of 18 and 40 may apply.

- Pension Amount: The subscriber determines the pension amount based on his contributions and age at the time of joining the plan.

- Up until the age of 60, the subscriber must make contributions to the plan. The subscriber’s age and preferred pension amount determine the contribution amount. For a monthly pension of Rs. 1,000, the contribution is as little as Rs. 42.

- Return: The government guarantees a return on the contribution made to the program.

- Tax Benefits: Section 80 SEC of the Income Tax Act allows contributions made to you to be tax-deductible.

- Withdrawal: Only in the event of death or a terminal illness does the subscriber receive the money they’ve saved up before turning 60. The subscriber’s accumulated sum may be paid to the nominee in the event of death.

- Automatic Deduction: The subscriber’s bank account may be used to deduct the contribution towards the program automatically.

Objectives of APY

- To offer a social safety net for employees of the unorganized sector who cannot afford expensive pension plans.

- to encourage the low-income population to develop saving habits.

- to offer subscribers a guaranteed pension.

Atal Pension Yojana Eligibility / APY age limit

- Any Indian citizen between the ages of 18 and 40 may sign up for the program.

- The client must own both an Aadhaar card and an active bank account.

Advantages of APY / Atal pension Yojana benefits

- Financial stability: Following retirement, APY offers customers financial stability. To guarantee that the subscriber would have a consistent income after retirement, a fixed pension amount is used.

- little Contribution: The monthly contribution to the scheme is as little as Rs. 42, which is incredibly minimal.

- Guaranteed Return: The government may guarantee the return on the contributions made to the plan.

- Tax Benefits: Section 80 SEC of the Income Tax Act allows contributions made to the plan to qualify for tax breaks.

- The plan is portable, which enables the subscriber to continue using it even after moving to a new place.

- Simple Enrollment: You can enroll in AAPI online or offline, and the process is fairly straightforward.

- No Medical Exam is Necessary: Enrollment in APY is not subject to a medical exam.

Atal Pension Yojana’s Drawbacks

- Limited Coverage: Because the program is only available to those working in the unorganized sector, it does not extend coverage to those employed in the organized sector.

- Lower Pension Amount: Compared to other pension plans, the APY offers a lower pension amount.

- Inflation: Because the pension amount provided by APY is not adjusted for inflation, its purchasing power declines over time.

- Restrictions on withdrawal: The customer’s freedom is limited because they can only withdraw the accrued funds in the event of death or a terminal illness.

Atal Pension Yojana Apply online

- Visit the Atal Pension Yojana website and select “APY e-enrolment” from the menu.

- the information for your bank account and Aadhaar card

- Choose the monthly, quarterly, or half-yearly contribution frequency and pension amount.

- I’ll give you my email and mobile number for further contact.

- Send the application, and you’ll get a confirmation number.

Conclusion

A government-backed pension program called Atal Pension Yojana might give those employed in the unorganized sector financial security. This program offers a fixed pension amount at a modest contribution rate, and the government guarantees the return on contributions. However, this plan has some limitations, including low pension amounts, low coverage, and withdrawal limits.